US-based digital health companies raised $6.4B in H1 2025

Rock Health is out with its latest report on digital health funding in the U.S. and here's what it shows...

The first half of 2025 didn't just whisper progress — it hollered. AI-powered startups caught fire, landmark IPOs shook off a years-long freeze, and digital health tooling found its stride with clinicians. Money moved steadily, and impact followed close behind.

But while the sector basked in the glow of big checks and public debuts, the broader stage looked less steady. Between policy shakeups and economic crosswinds, digital health pressed forward anyway, turning potential into proof.

As Sofia Guerra of Bessemer Venture Partners put it: "To improve those odds, vendors need to earn customer trust, which requires highly secure, accurate, easy-to-use tools... Make it a no-brainer for health systems to adopt."

Let's dive into the highlights — and why they matter.

Highlights

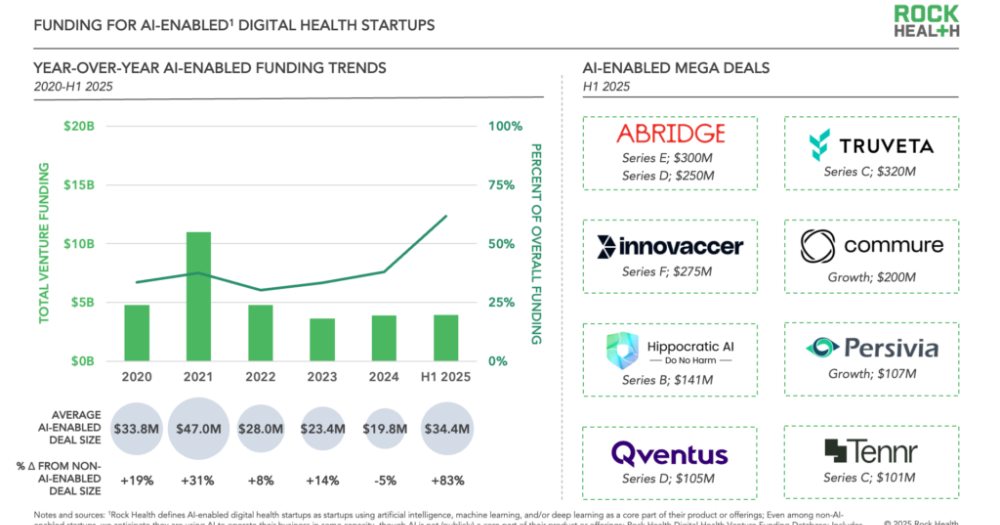

- $6.4B in digital health venture funding across 245 U.S. deals

- AI-native startups snatched 62% of that capital, raising 83% more per round than their peers

- Ambient AI tools like Abridge saw adoption rates hit 30-90% in hospitals

- OpenEvidence surged past 100K clinician users

- Hinge Health and Omada Health broke the IPO drought

- 107 M&A deals in H1 alone, pointing to a banner year for strategic exits

- PE firms like New Mountain Capital are stitching together AI and legacy players in roll-up experiments

Why Does It Matter?

Because for once, we're not just speculating — we're seeing outcomes.

Digital health has long promised better, faster, cheaper care. Now, tools are earning physician trust, showing clinical value, and getting rolled out at scale. Investors are no longer just betting on ideas — they're backing performance.

"Over the last decade, the foundation of Hinge Health has been built on... an exceptional, clinically-validated member experience," said Jim Pursley, President of Hinge Health. "AI and computer vision were a critical third element."

And in a policy climate riddled with uncertainty, proof points like these give the industry something to rally around.

The Context

Zoom out, and the backdrop's a bit messier.

The MAHA (Make America Healthy Again) plan under the Trump administration has sparked a whirlwind of executive orders — targeting everything from AI deregulation to drug pricing. A looming budget bill threatens to leave millions uninsured, raising the stakes for care delivery startups relying on broad access and reimbursements.

Meanwhile, venture funding held firm — but didn't surge. The number of deals dropped, even as average deal size grew. That suggests a more cautious but committed investor mindset: fewer bets, bigger checks.

As for exits, they are finally back. Hinge and Omada's public offerings revived hope after a long dry spell. Yet, both companies are still battling for profitability, even as their valuations recalibrate.

On the private side, M&A is sizzling. Companies are using acquisitions to fill gaps and build robust portfolios. PE firms are taking bolder swings — combining legacy players with fresh AI blood, hoping the sum is greater than the parts.

As Rachel Stauffer of McDermott+ notes: "There are more opportunities than ever before for digital health companies to get involved and steer evolving regulations... They are sincerely hoping to hear from as many people as possible."

That's not just a policy footnote — it's a rallying cry.

From tool adoption to public debuts, the first half of 2025 showed us that digital health isn't just surviving. It's scaling. The sector has moved from selling a dream to delivering results. The pudding's here — and the proof is in it.

Now, what about the GCC and the MENA region? Will it enter the digital health / HealthTech boom soon? We're here to help, have no doubts about it.

💡Did you know?

You can take your DHArab experience to the next level with our Premium Membership.👉 Click here to learn more

🛠️Featured tool

Easy-Peasy

Easy-Peasy

An all-in-one AI tool offering the ability to build no-code AI Bots, create articles & social media posts, convert text into natural speech in 40+ languages, create and edit images, generate videos, and more.

👉 Click here to learn more