U.S. digital health companies raised $3.5B in Q3 2025

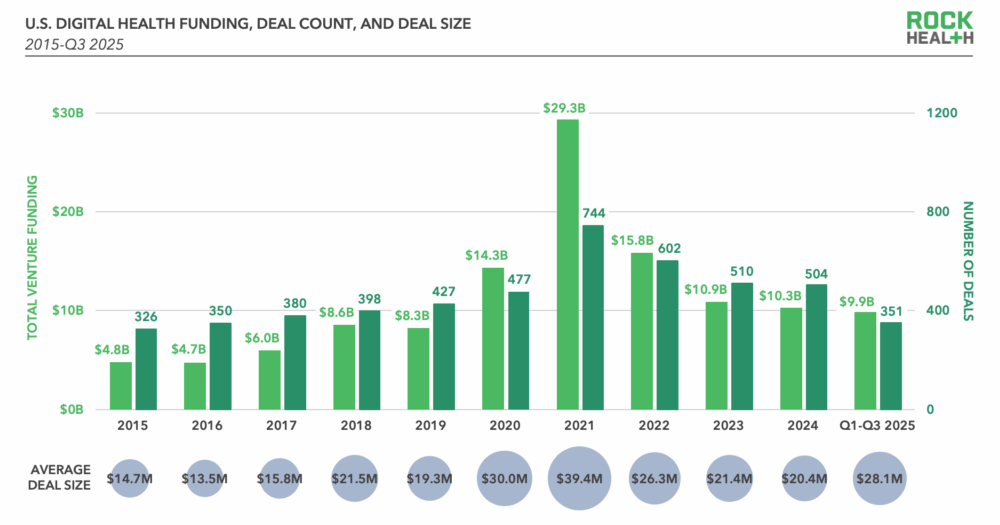

At first glance, digital health funding in Q3 2025 looks calm — steady even. Investors poured $3.5 billion across 107 deals, pushing the year's total to $9.9 billion across 351 deals, outpacing the total for 2024. The IPO window's cracked open again, capital's flowing, and mega deals keep dropping. But beneath that smooth surface, signals are out of sync. What once seemed like short-term quirks — like unlabeled rounds or stretched fundraising timelines — have become the new normal.

The digital health market isn't just maturing; it's mutating under pressure. Health systems are feeling the squeeze, policymakers are shifting priorities, and AI has moved from sidekick pilot projects to core infrastructure. Everyone — startups, investors, incumbents — is recalibrating. Every bet now carries more weight.

Highlights

- $3.5B raised in Q3 2025, totaling $9.9B year-to-date, topping last year's pace.

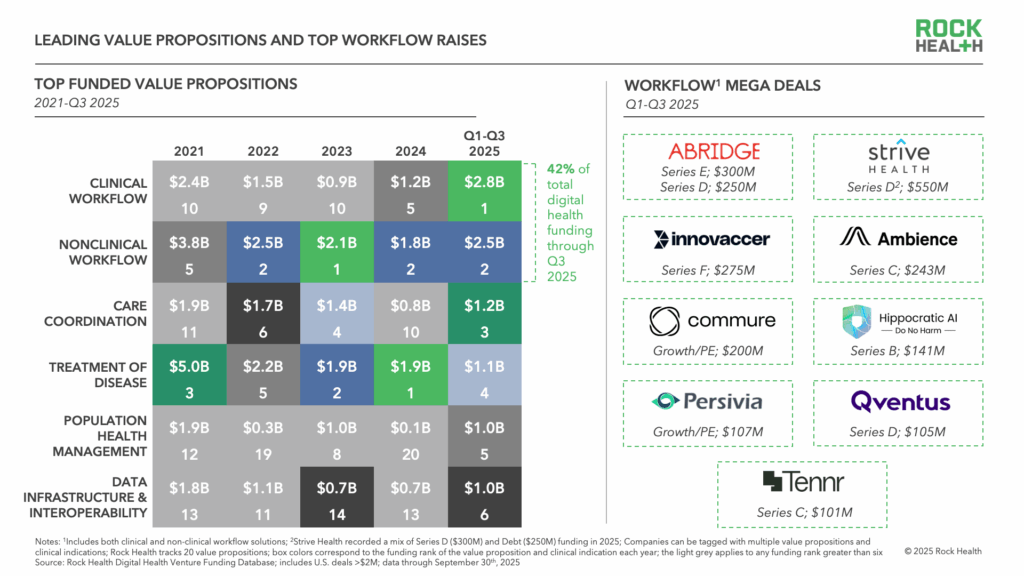

- Mega deals continue to dominate: 19 rounds of $100M+ already this year, including Strive Health ($550M), Judi Health ($400M), Ambience ($243M), and Aidoc ($150M).

- Average deal size climbed to $28.1M, up from $20.4M in 2024.

- 35% of all rounds remain unlabeled, muddying traditional benchmarks.

- Series B rounds are thinning out — just 30 so far this year, compared to over 60 annually before.

- Workflow and infrastructure tools are winning big, pulling in 42% of total sector funding.

- Acquisitions up 37%, signaling a push toward horizontal integration.

- Incumbents like Epic, Oracle, and Innovaccer are folding AI-driven workflows directly into core platforms.

Why does it matter?

The numbers might look fine, but the narrative's shifting. The market's splitting into two worlds: a handful of companies raising monster rounds at lightning speed — and everyone else struggling to find footing. Those in the middle, especially at Series B, are thinning out.

For founders, unlabeled rounds buy time, but at a cost. They blur visibility, making it harder for investors to read the tea leaves. Two startups announcing bridge rounds might be on completely different trajectories — but good luck telling which is which.

As Becca Shmukler of Million Lives Fund puts it, "There's a set of companies raising quickly at high valuations — and then there's everyone else. For those navigating the tougher path, the playbook is to find the moat and double down on clear differentiators."

It's not just about raising capital anymore. It's about proving staying power. Investors are no longer chasing hype — they're hunting durability, scale, and trust.

The context

The concentration game

Funding concentration is reshaping digital health's pecking order. Roughly 80% of mega deals this year had the fingerprints of Andreessen Horowitz, Kleiner Perkins, or General Catalyst. Capital's clustering around the few — pulling market benchmarks out of alignment and leaving smaller players gasping for oxygen.

The "missing middle"

The pipeline between Series A and B has grown foggy. The median time between those rounds jumped to 27 months, up from 17 months two years ago. Fewer startups are hitting growth milestones cleanly, forcing many into unlabeled "pit stops." It's become a waiting game where investors look for proof — FDA clearance, major distribution wins, or real commercial traction — before doubling down.

The workflow wars

While traditional signals blur, one theme is shining through: workflows and infrastructure are where the action is. Startups like Abridge, OpenEvidence, and TransformativeMed are racing to own the "operating layer" of healthcare — building tools that make daily work actually work.

The sector's shifting from flashy AI demos to nuts-and-bolts productivity. As Julie Wroblewski of Magnify Ventures said at Rock Health Summit 2025, "We'll continue to see consolidation and powerful platforms emerge, but there's also room for specialized solutions... It's not either-or — it's both greater breadth and depth."

The incumbents strike back

Legacy giants aren't standing still. Epic has woven clinician support, billing automation, and patient-facing AI into its core EHR. Oracle and Innovaccer are following suit. The race is on to own the AI-driven workflow stack — but with complexity comes risk. Too many layers can slow iteration and frustrate users, leaving room for leaner startups with sharper ROI stories.

In short: what looks steady is anything but. Beneath the calm surface, the market's redrawing itself — fast. Digital health's next chapter will belong to those who can not just raise money, but prove, with data and delivery, that they deserve it.

💡Did you know?

You can take your DHArab experience to the next level with our Premium Membership.👉 Click here to learn more

🛠️Featured tool

Easy-Peasy

Easy-Peasy

An all-in-one AI tool offering the ability to build no-code AI Bots, create articles & social media posts, convert text into natural speech in 40+ languages, create and edit images, generate videos, and more.

👉 Click here to learn more