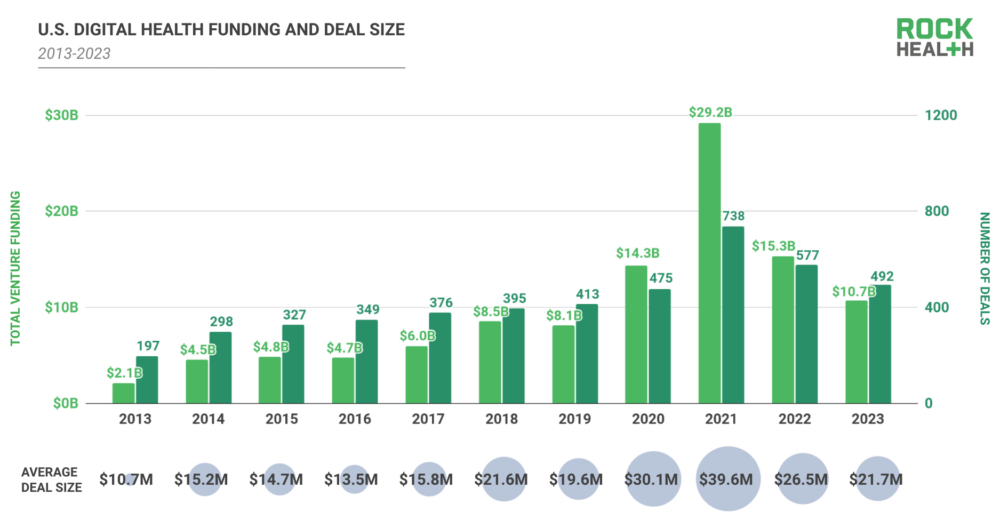

Rock Health: U.S. digital health companies raised $10.7B across 492 deals in 2023

Rock Health released its annual report, highlighting venture funding in the U.S. digital health market.

Following trends in the broader venture market, 2023 saw venture funding dive in digital health-continuing the downhill trajectory that began in 2022. Annual venture funding for 2023 closed out at $10.7 billion raised across 492 deals, the lowest amount of capital invested in U.S.-based digital health startups since 2019.

In 2023, M&A activity did not increase, even though cash-strapped startups were expected to look for buyers. And despite tightening capital availability and a sluggish exit market, there wasn't a pronounced spike in startup shutdowns, though there were some notable bankruptcies and asset sales.

Highlights

Here's what you should know:

- Series extensions: 2023 saw a wave of extension raises, particularly at the A and B deal stages. Extension raises, particularly at early stages, can sustain startups that haven't yet nailed down key maturity markers like product-market fit or go-to-market strategy but need additional cash. For others, extension raises help startups compete, leveraging new financing to generate outcomes data or secure strategic investor guidance before the next raise.

- Unlabeled rounds: In a new annual record, 44% of 2023's fundraising deals were unlabeled (i.e., not designated by a letter, such as "Series C").

- Silent rounds: Many companies have quietly accessed additional funding from their existing set of investors. There is no way to systematically track rounds that aren't reported, but the anecdata indicates that 2023 saw more than its fair share of unannounced, inside-round financings.

For some companies, extension, unlabeled, or silent rounds may have bought just enough time to hit key commercial and outcome benchmarks. Also, for some startups continuing forward, these creative financing measures are realistically one-time assists, and can't be continuously relied upon if additional financing is needed.

Predictions for 2024

With transition funding options exhausted, startups won't be able to avoid or delay major moments like fundraises or exits for much longer. For some, the next step will be returning to labeled fundraises, but at adjusted valuations. For others, it's making a (public or private) exit, possibly with a lower price tag than expected. Here are some hunches for what's to come in 2024.

- Labeled raises will return: The cohort of startups that bought time in 2023 with creative financing will likely need to raise more substantial funding via labeled rounds in 2024. As these startups consider the case for their next raise, some will find themselves well-positioned for success; solid financials, exceptional founding teams, and proven outcomes data will set this class apart. However, others will find themselves less prepared to demonstrate the commercial maturity expected at their next labeled round and will need to evolve strategies to meet the mark and attract investor attention.

- M&A pace will accelerate: While there were some notable transitions across 2023, an overall M&A swell didn't materialize. Likely due in part to a combination of "higher for longer" interest rates and volatile capital markets early in the year, 2023 M&A volume was 23% lower than in 2022, with 146 total announced mergers/acquisitions of US-based digital health companies this year, compared to 2022's 190.

- The public market cohort will recalibrate: After a year without a single digital health public exit, a recomposition of the digital health public market in 2024 seems increasingly likely — faltering public companies will likely delist while late-stage players finally take aim at public exits. Though some companies may attempt to avoid delisting by leveraging stock restructuring or cutting down operational expenses, Rock Health expects that a few additional digital health companies will leave the public market altogether in 2024.

Conclusion

Looking ahead, 2024 will be a year of recalibration and consolidation. Some startups will rally, finding that high capital efficiency and exceptional offerings pay off to secure them their next major fundraise. Others will need to make the tough call to wind down operations or accept lower-than-hoped-for M&A offers, particularly in saturated segments.

Even though we'll see teams and startups wind down in 2024, the talent and ideas will carry on. Individuals may go on to problem-solve in new ways, responding to market dynamics by launching new ventures or innovating at enterprises. Assets that were sunset may find second lives in new companies or as a part of new platforms.

Ultimately, Rock Health expects a coming reset to create a more efficient, sustainable, and innovative digital health ecosystem. And that's something good to look forward to!

💡Did you know?

You can take your DHArab experience to the next level with our Premium Membership.👉 Click here to learn more

🛠️Featured tool

Easy-Peasy

Easy-Peasy

An all-in-one AI tool offering the ability to build no-code AI Bots, create articles & social media posts, convert text into natural speech in 40+ languages, create and edit images, generate videos, and more.

👉 Click here to learn more