Report: H1 2024 digital health funding in the U.S. hits $5.7B billion

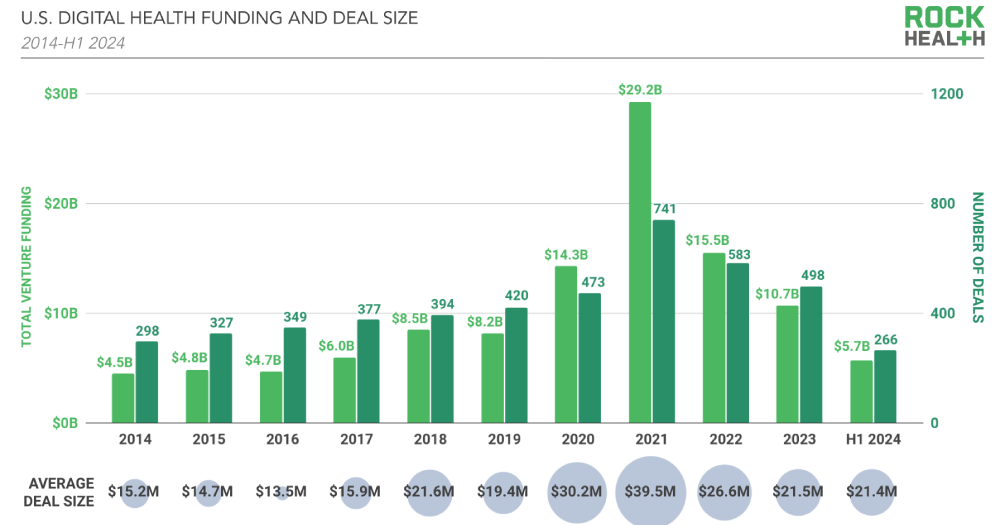

Rock Health has recently released its half-year report covering funding for digital health startups in the U.S. And the numbers speak for themselves, with 2024 funding dollars and deal counts set to exceed 2019 and 2023 historicals — two years that serve as helpful comparators outside of the pandemic-fueled funding cycle from 2020 to 2022.

In total, U.S. digital health startups raised $5.7 billion across 266 deals during the first half of the year. Also, early-stage checks are growing, the proportion of unlabeled deals is tapering, and the digital health IPO market shows early signs of life.

Highlights:

Here are the key findings from Rock Health's report:

- Early-stage energy: Most of H1's energy came from early-stage deals, with Seed, Series A, and Series B checks accounting for 84% of labeled raises. Series A activity was especially strong in H1, with a median deal size of $15M in the cohort, $3M larger than the median Series A in 2023. For early-stage startups using AI (38% of digital health companies that raised A rounds in H1 2024 were AI-enabled), big Series A rounds can help support AI upstart costs like training models or acquiring datasets.

- Unlabeled rounds begin to wane: For the past few quarters, Rock Health has been tracking the percentage of startups raising unlabeled rounds. Unlabeled rounds tend to spike during transition periods between market conditions, when startups need access to capital but don't meet benchmarks for their next labeled raise and/or are trying to delay tough conversations on valuation. Looking quarter-over-quarter from Q1 2023 to Q2 2024, the prevalence of unlabeled deals has started to taper. Q1 and Q2 2024 showed a decline in the percentage of unlabeled raises (47% and 33%, respectively) from a peak of 55% in Q4 2023.

- AI and other drivers: While on-demand healthcare is still a central part of digital health (and H1's fifth-most funded value proposition for digital health startups), today's investors are supporting a much more diverse mix of solutions informed by consumer trends, market trends like commoditization and specialization, and of course, AI. One in three dollars invested in H1 (34% of total sector funding) went to digital health startups leveraging AI, which helped to shape the rankings of digital health's top-funded value propositions and clinical indications this half.

- Investments across categories: Treatment of disease grabbed the top funding spot by value proposition ($1.1B total), followed by nonclinical workflow tech ($896M), R&D for pharma and medical devices ($737M), and clinical workflow ($639M). Also prominent was mental health, with $682M raised in H1 2024, while headlines in weight management and obesity care bolstered funding for startups in the category ($261M). Lastly, investments in companies developing menopausal and pelvic health solutions bumped H1 funding for reproductive and maternal health to $214M.

- IPOs are back: After 21 months without a public exit, Q2 2024 saw three digital health companies exit onto the Nasdaq or NYSE: remote fetal monitoring platform Nuvo (public exit via SPAC in May 2024), revenue cycle management company Waystar (IPO in June 2024), and precision diagnostics player Tempus AI (IPO in June 2024). This activity mirrors a modest IPO uptick in the broader markets, as well as natural forward movement for some late-stage digital health companies.

- M&A activity is (slightly) down: Acquisitions of digital health companies by other digital health companies have dropped, clocking in at 34 deals in H1 2024, less than half of 2023's total (83 deals). Also, PE firms acquired 10 digital health startups in H1 2024, more than the total number of digital health acquisitions they made in 2023.

On the record

"The Series A pipeline is quite strong right now, and these early-stage rounds can feel like cleaner deals because they don't have valuation overhangs," said Cheryl Cheng, Founder and CEO, Vive Collective.

"AI is helping us combine multiple parts of the care journey, across all care experiences. In the future, benefits navigation, clinical guidance, and care delivery won't be delivered by separate companies or point solutions within the healthcare ecosystem. They'll be features that work in concert within products, and they'll happen in under 90 seconds for a seamless patient experience," said Glen Tullman, CEO, Transcarent and Managing Partner, 7wireVentures.

"There are many good companies trying to get bought, but it's hard to make those deals work. Even if they are interesting companies, potential buyers are focused on their immediate priorities. Anything that is not directly related to what we are trying to get done is de-focusing and incredibly risky," added Joanna Strober, Founder and CEO, Midi Health.

The bottom line

The digital health sector continues to demonstrate resilience and adaptability. Funding momentum (especially at the early stage) and the tapering of transition measures like unlabeled rounds hint that we might be returning to more "normal," sustainable venture patterns.

Big questions still loom on the horizon — like how the U.S. presidential election will shake out, what will happen to virtual care flexibilities, and which digital health roles retailers will ultimately choose to play. Yet, the first half of 2024 proved that digital health founders and investors have their eyes on the prize, which gives us confidence in what's to come.

💡Did you know?

You can take your DHArab experience to the next level with our Premium Membership.👉 Click here to learn more

🛠️Featured tool

Easy-Peasy

Easy-Peasy

An all-in-one AI tool offering the ability to build no-code AI Bots, create articles & social media posts, convert text into natural speech in 40+ languages, create and edit images, generate videos, and more.

👉 Click here to learn more