Report: Healthcare market in MENA hit $243.6 billion in 2023

Entrepreneur Middle East and Lucidity Insights have launched a new report titled, The Business of Healthtech in MENA.

The MENA region's healthcare market is projected to grow at a compounded annual growth rate (CAGR) of 11.7% from US$185.5 billion in 2019 to $243.6 billion in 2023. In addition, current healthcare expenditure in the GCC was estimated to have reached $105 billion in 2022.

Demand for healthcare services in the region is soaring, unlocking immense investment opportunities. The UAE alone accounts for 25% of the GCC healthcare spending, with the government having historically been the primary investor — new data shows private sector participation has increased significantly in the past decade. The latest research shows that the digital health market, a growing segment within healthtech, in the United Arab Emirates and Saudi Arabia alone could reach $4 billion by 2026.

The UAE has already registered over 250 healthtech startups in its ecosystem. The MENA region has a fast-evolving healthcare ecosystem, and the diversity of the countries in the region has resulted in various approaches to health management — with varied access to healthcare and health expenditures, resulting in disparities in healthcare and health outcomes across the region.

The MENA also has the lowest healthcare expenditure in the world at 6% of gross domestic product (GDP), compared to the world average of 10%, or the USA, which spends 17% of its GDP on healthcare. However, the MENA region has one of the highest out-of-pocket expenses as a percentage of expenditure in the world — possibly in part due to younger demographics in the region. High out-of-pocket expenditures for healthcare is often associated with negative health outcomes, but this depends on the wealth of each country's population.

Of course, the MENA region has some of the youngest populations in the world, requiring infrequent access to healthcare services. Country demographics certainly play a role in how much a country spends on healthcare, as well as on its out-of-pocket payment policies. The region is likely to see a shift, particularly expected to be witnessed in the GCC markets over the next two decades, as countries like the United Arab Emirates will go from housing a population that is over 60 years old at 3% in 2020, to grow to 20% of the population by 2050.

All of this points to more reasons for healthcare innovation in the region over the coming decades. In that sense, funding has increased in the MENA healthtech space over the past few years — with a particular bump seen during the pandemic years, which saw many healthcare providers invest in technology and digitalization.

Though 2023 has seen a drop in venture funding for healthtech startups driven by the ongoing VC winter, funding is still higher than pre-pandemic levels, and funding rounds have grown, indicating investments in later-stage healthtech players.

Healthtech has been exploding in the region, with valuations of healthtech startups seeing a significant jump since the COVID-19 pandemic started in 2020.

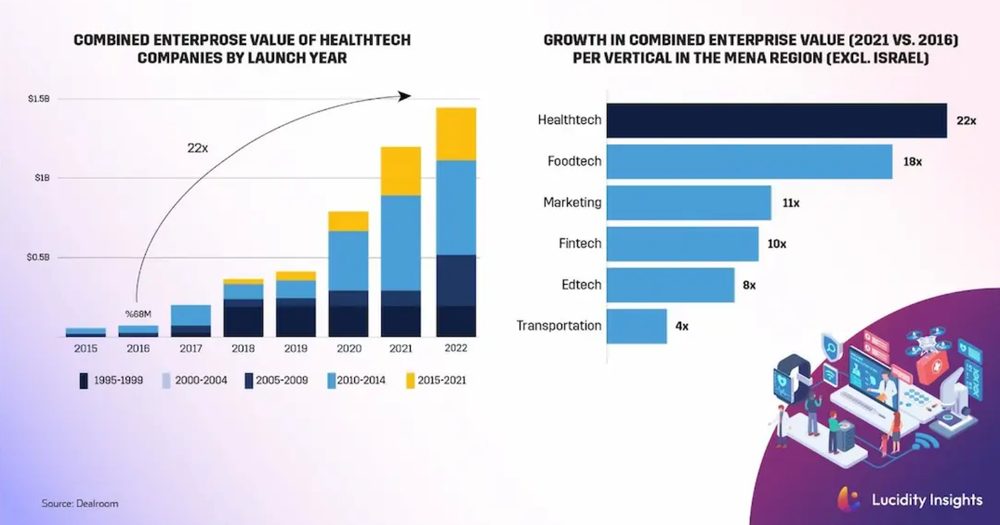

According to Dealroom, healthtech companies in MENA (excluding Israel) have reached a combined value of over $1.5 billion in 2022, a 22x increase since 2016. This makes it the fastest-growing tech sector in the MENA region, solving real-world problems.

Interestingly, though some healthtech startups that were founded in the 1990's and 2000's have also seen an increase in value, it is those startups that were established after 2010 that are most highly valued today. This likely speaks to the sophistication and level of technological innovation that we have witnessed in the past 15 years in particular.

Healthtech startups saw the highest valuation growth, followed by foodtech and marketing software-as-a-service companies. This was likely driven by the pandemic, which quickly educated both consumers and healthcare institutions on the value of technology to increase efficiencies, as well as the new technologies that have come online in the most recent years — which have seen an increase in business models coming to the MENA region that have already proven themselves on the global stage.

In terms of hot subsectors, care delivery is the most funded healthtech vertical in MENA (excluding Israel), which represents 39% of all funding flows, followed by administrative workflow startups that have garnered 30% of VC funding. Digital therapeutics rounds out the top three with $97 million invested, accounting for 16% of all VC funding in the region's healthtech sector.

As for the hottest healthtech incubation hot spots across the region, the United Arab Emirates is the startup capital of the MENA region (data excludes Israel), based on healthtech funding raised between 2009 to Q3 2023. UAE-based healthtech players have cumulatively raised $460 million in this time, while, in second place, Egypt follows with a collective $74 million raised. That means that 75% of all VC funding going to MENA healthtech is going to UAE startups. It's no surprise then that nine out of ten of the most funded healthtech startups in the MENA are headquartered in the UAE.

The report also highlights global trends, and profiles healthtech unicorns on the global stage. You can get more details from here.

💡Did you know?

You can take your DHArab experience to the next level with our Premium Membership.👉 Click here to learn more

🛠️Featured tool

Easy-Peasy

Easy-Peasy

An all-in-one AI tool offering the ability to build no-code AI Bots, create articles & social media posts, convert text into natural speech in 40+ languages, create and edit images, generate videos, and more.

👉 Click here to learn more